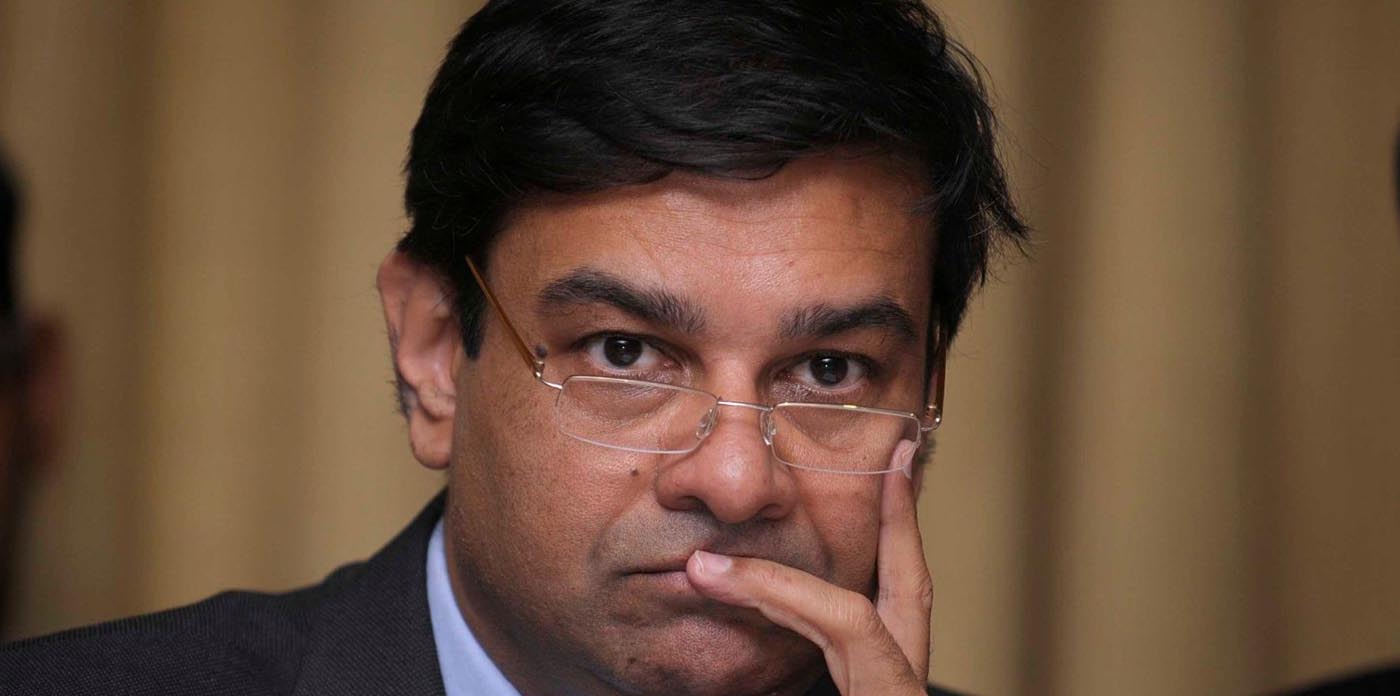

Urjit Patel assumes charge as new RBI Governor

September 05, 2016

Mumbai: Urjit Patel who took over as the 24th Governor of Reserve Bank will have a tough task in maintaining the legacy of his predecessor, Raghuram Rajan, and balance the need to contain inflation without hurting growth.

Patel assumed charge effective September 4, 2016, after serving as deputy governor since January 2013, RBI said in a statement today.

He was reappointed as deputy governor on January 11, 2016, after the completion of his first three-year term in office.

Ensuring undisruptive redemption totalling USD 20-25 billion, getting used to the idea of Monetary Policy Committee and bank cleanup are the main challenges before the new Governor.

According to Rajiv Kumar, Senior Fellow at Centre for Policy Research, the first task before him is to get used to the idea of working with the Monetary Policy Committee (MPC).

“He has to devise a way of working with the committee and getting to the objective of meeting inflation target. Besides, containing food inflation is another challenge before him,” Kumar said.

If food inflation raises its head again then what strategy he will employ to contain it, he asked.

Besides, he should work in a manner that RBI versus the Finance Ministry situation is avoided as all the components are working towards inflation control and employment generation and finally what approach he will adopt to clean balance sheet of the bank or strengthen banks.

Among his assignments as deputy governor, Patel chaired the Expert Committee to Revise and Strengthen the Monetary Policy Framework.

“Representing India, he actively participated in steering the signing into force of the inter-governmental treaty and the Inter-Central Bank Agreement (ICBA) among the BRICS nations, which led to the establishment of the Contingent Reserve Arrangement (CRA), a swap line framework among the central banks of these countries,” RBI said. .

Patel has also served at the International Monetary Fund (IMF). He was on deputation from the IMF to RBI during 1996-1997, and in that capacity he provided advice on development of the debt market, banking reforms, pension reforms, and evolution of the foreign exchange market.

He was a Consultant to the Ministry of Finance from 1998 to 2001. He also had other assignments in public and private sectors, including with Reliance Industries, IDFC Ltd, MCX Ltd and Gujarat State Petroleum Corporation.

Dr Patel, as he is commonly referred to as, has worked closely with several central and state government high level committees. These include the Task Force on Direct Taxes, the High Level Expert Group for Reviewing the Civil & Defence Services Pension System, the Prime Minister’s Task Force on Infrastructure, the Group of Ministers on Telecom Matters, the Committee on Civil Aviation Reforms and the Ministry of Power’s Expert Group on State Electricity Boards.

He has several publications in areas of Indian macroeconomics, monetary policy, public finance, financial sector, international trade, and regulatory economics, the RBI said.

Patel has a PhD in economics from Yale University, an M Phil from University of Oxford and a BSc from the University of London.

Besides, Patel should work in a manner that RBI versus Finance Ministry situation is avoided as all the components are working towards inflation control and employment generation and finally what approach he will adopt to clean balance sheet of the bank or strengthen banks.

A number of corporate leaders and bankers who have previously worked with Patel, including during his tenure as RBI’s Deputy Governor and earlier on boards of some companies, said he is expected to show “much better understanding” of the problems the companies and banks are facing due to the central bank’s AQR (Asset Quality Review) directive.

Some are even hopeful that the AQR regime may actually see some change, though Rajan kept on repeatedly saying in his last days at RBI that the process should be completed by March 2017, a target he had set for cleaning up of the banks’ balance sheets.

With public sector banks accounting for a large portion of the bad loans, the clean-up exercise has raised heckles of many in the government as well, though not many have been public with their views, fearing adverse commentary.

Among his assignments as deputy governor, Patel chaired the Expert Committee to Revise and Strengthen the Monetary Policy Framework.

“Representing India, he actively participated in steering the signing into force of the inter-governmental treaty and the Inter-Central Bank Agreement (ICBA) among the BRICS nations, which led to the establishment of the Contingent Reserve Arrangement (CRA), a swap line framework among the central banks of these countries,” RBI said.

Patel has also served at the International Monetary Fund (IMF). He was on deputation from the IMF to RBI during 1996-1997, and in that capacity he provided advice on development of the debt market, banking reforms, pension reforms, and evolution of the foreign exchange market.

He was a Consultant to the Ministry of Finance from 1998 to 2001. He also had other assignments in public and private sectors, including with Reliance Industries, IDFC Ltd, MCX Ltd and Gujarat State Petroleum Corporation.

Related Stories

RBI Governor Urjit Patel resigns from his post

Change of guard at RBI: Urjit Patel's tenure begins

Top bankers welcome Patel's appointment as RBI Governor

Dr. Urjit Patel appointed new Governor of Reserve Bank of India

Recent Stories

- Surat Congress candidate Nilesh Kumbhani's nomination form facing invalidation procedure

- ACB Gujarat decoy traps private hospital's staffer for bribery

- Chaitar Vasava has 13 FIRs against him under over 30 IPC sections in 3 police stations

- WR to run 2 pairs of Sabarmati-Barmer Special trains for summer

- ACB Gujarat files offence against SK Langa and son for disproportionate asset

- Kshatriya agitators announce part-2 programs in Gujarat

- FM Sitharaman on Gujarat visit