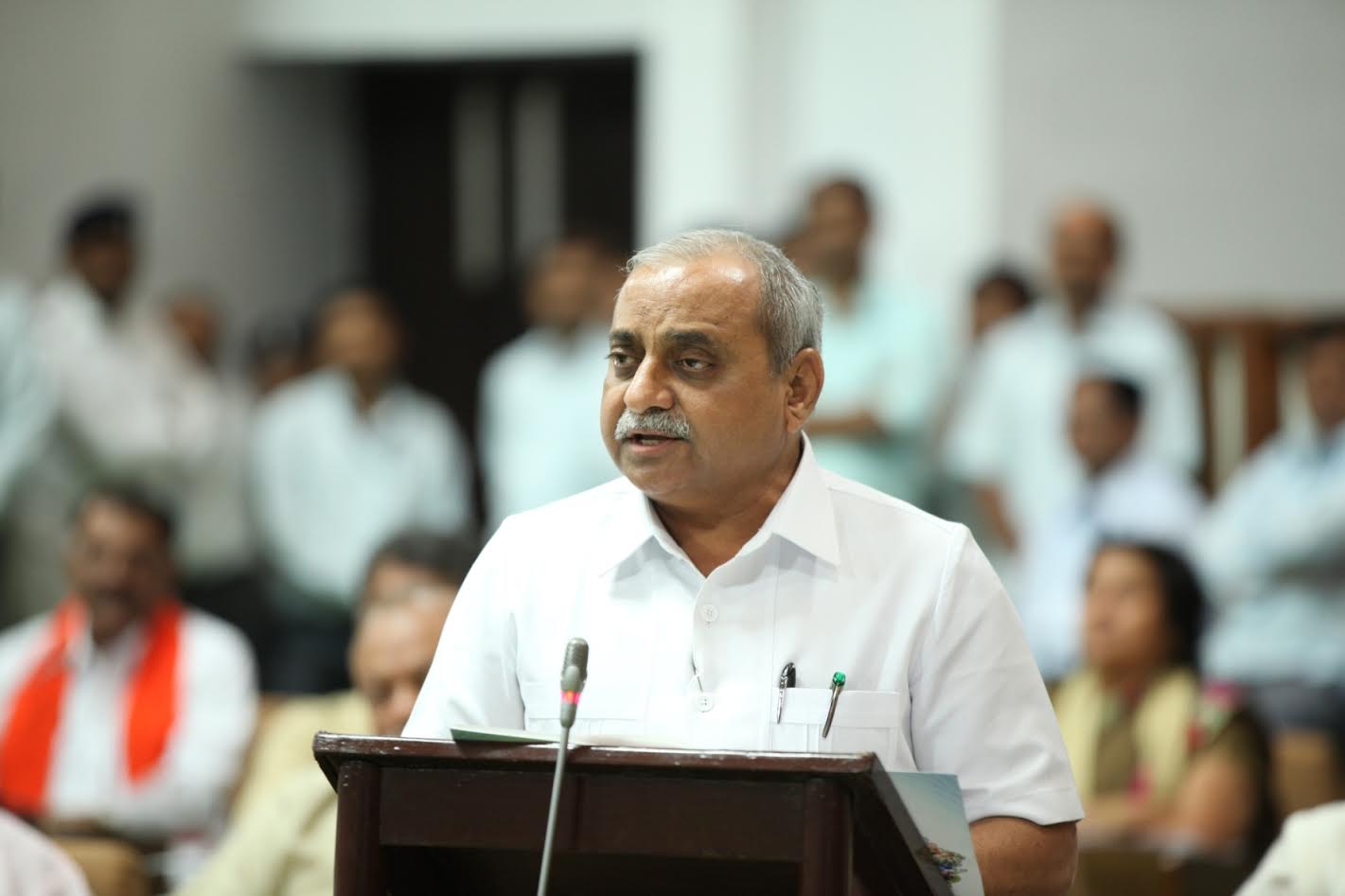

Petrol and diesel under GST would be loss-making business for States: Nitin Patel

March 23, 2018

Gandhinagar: Gujarat will lose half of its tax collection to the Centre if petrol and diesel were brought under the GST, the Gujarat government said today in the assembly and made it clear that it will not bring petrol and diesel under the ambit of GST as such step would make significant reduction in the state revenue. The 50-50 revenue sharing formula of the GST is like running a loss-making business, the state will have to give away 50% tax revenue to the Centre, while under the VAT, the state is getting the entire chunk of tax on fuel, the government said adding that for this reason only, finance ministers of all the states agreed during the GST Council meetings to put fuel items outside the GST. VAT on fuel is the main source of income for the State. Finance Minister Nitin Patel said the 20% tax on petrol and diesel in Gujarat is much lower than in many other states, perhaps the lowest in the country.

DeshGujarat

Related Stories

Petrol and Diesel cheaper by Rs. 5 per litre in Gujarat thanks to Rs. 2.50 cut declared each by Centre and State

Centre announces Rs 2.50 cut per litre in petrol/diesel prices, asks States to declare cut of equal amount

Recent Stories

- Chaitar Vasava: AAP MLA with multiple run-ins with the law, a long list of controversies

- Western Railway block on July 10 to affect few trains passing via Gujarat

- Which places in Gujarat might see heavy rainfall as per IMD forecast till July 14?

- Kharai camels swim across sea from Kutch to Dwarka

- Mumbai-Ahmedabad Bullet Train project: Bridge over Daman Ganga River complete

- In Pictures: Surat's indoor sports facility center under Parle Point bridge garners praise from Tweeples

- Longest coastline, yet not a single sea cruise in Gujarat; govt to now bring Cruise Shipping Policy