GST Council doubles annual turnover threshold for GST registration to Rs 40 lakhs

January 10, 2019

New Delhi: Under the originally GST structure in July 2017,there was a provision that those with annual turnover of upto Rs. 20 lakh are considered within exemption. In North East and hill states the exemption limit was Rs. 10 lakh. J&K, Assam and some other states among hilly and North East category have amended laws and brought up the limit to Rs. 20 lakh. In today’s meeting it was decided to continue this twin structure.And so, Rs. 20 lakh threshold has been doubled to Rs. 40 lakh. So if one with upto Rs. 40 lakh annual turnover doesn’t want to claim GST chain benefit, he/she is considered exempted. And in small states the limit was Rs. 10 lakh which is now Rs. 20 lakh. There’s an option given. If they want to raise their limit to Rs. 40 lakh instead of Rs. 20 lakh, they are given freedom to optout. One state Puducherry had sought this option of Opt up or Opt down depending on revenue. This is allowed as it doesn’t affect inter-state transaction.

Jaitley also said that from 1st April 2019, composition scheme limit will be increased to Rs. 1.5 crores. Those who come under the composition scheme will pay tax quarterly, but the return will be filed only once a year. The Council meet also approved composition scheme for Services.

Formal release

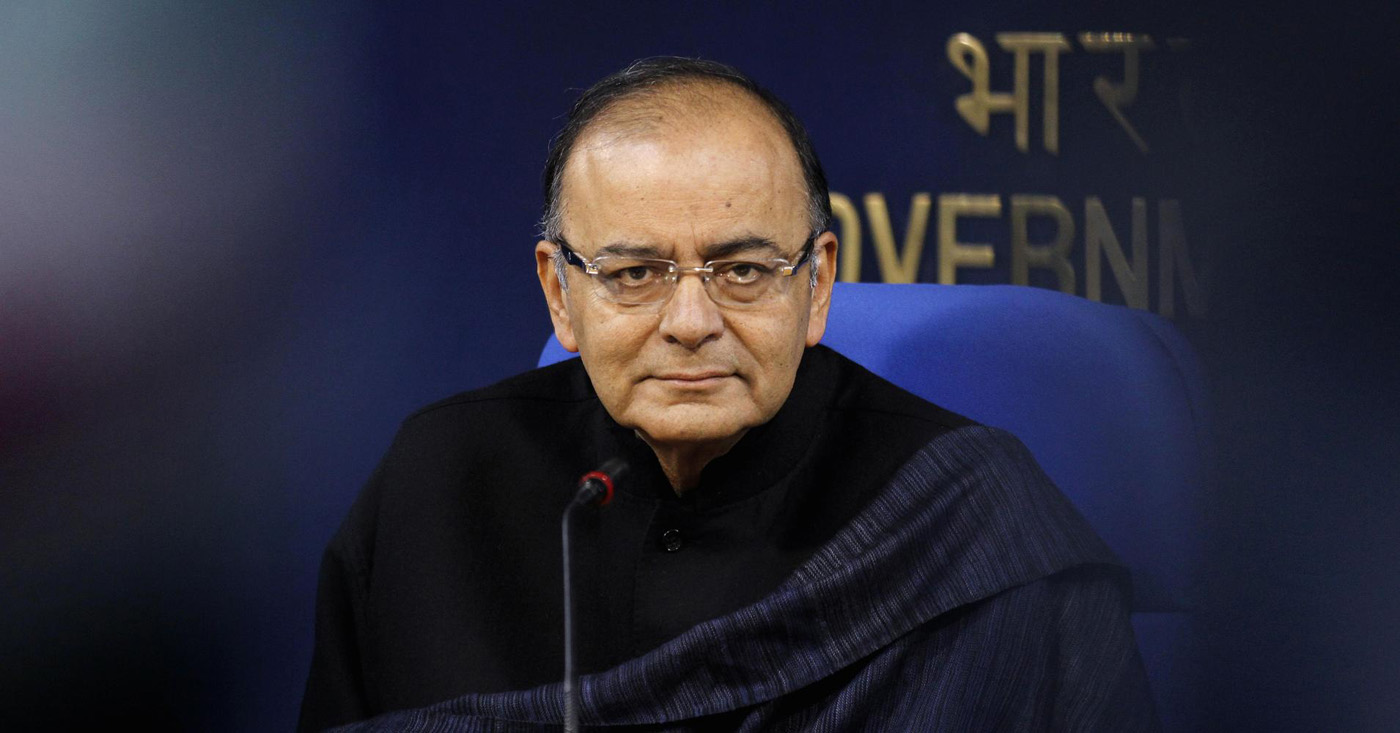

Major Decisions taken by the GST Council in its 32nd Meeting held today under the Chairmanship of the Union Minister of Finance & Corporate Affairs, Shri Arun Jaitley

The GST Council in its 32nd Meeting held today under the Chairmanship of the Union Minister of Finance & Corporate Affairs, Shri Arun Jaitley in New Delhi took the following major decisions to give relief to MSME (including Small Traders) among others –

1. Increase in Turnover Limit for the existing Composition Scheme: The limit of Annual Turnover in the preceding Financial Year for availing Composition Scheme for Goods shall be increased to Rs 1.5 crore. Special category States would decide, within one week, about the Composition Limit in their respective States.

1.1 Compliance Simplification: The compliance under Composition Scheme shall be simplified as now they would need to file one Annual Return but Payment of Taxes would remain Quarterly (along with a simple declaration).

2. Higher Exemption Threshold Limit for Supplier of Goods: There would be two Threshold Limits for exemption from Registration and Payment of GST for the suppliers of Goods i.e. Rs 40 lakhs and Rs 20 lakhs. States would have an option to decide about one of the limits within a weeks’ time. The Threshold for Registration for Service Providers would continue to be Rs 20 lakhs and in case of Special Category States at Rs 10 lakhs.

3. Composition Scheme for Services: A Composition Scheme shall be made available for Suppliers of Services (or Mixed Suppliers) with a Tax Rate of 6% (3% CGST +3% SGST) having an Annual Turnover in the preceding Financial Year up to Rs 50 lakhs.

3.1 The said Scheme Shall be applicable to both Service Providers as well as Suppliers of Goods and Services, who are not eligible for the presently available Composition Scheme for Goods.

3.2 They would be liable to file one Annual Return with Quarterly Payment of Taxes (along with a Simple Declaration).

4. Effective date: The decisions at Sl. No. 1 to 3 above shall be made operational from the 1st of April, 2019.

5. Free Accounting and Billing Software shall be provided to Small Taxpayers by GSTN.

6. Matters referred to Group of Ministers:

i. A seven Member Group of Ministers shall be constituted to examine the proposal of giving a Composition Scheme to Boost the Residential Segment of the Real Estate Sector.

ii. A Group of Ministers shall be constituted to examine the GST Rate Structure on Lotteries.

7. Revenue Mobilization for Natural Calamities: GST Council approved Levy of Cess on Intra-State Supply of Goods and Services within the State of Kerala at a rate not exceeding 1% for a period not exceeding 2 years.

DeshGujarat

Recent Stories

- Shah in Anand hails Salt Cooperative Initiative of Kutch, predicts Rs. 1 lakh crore Turnover of Amul next year

- Section 144 imposed after arrest of AAP MLA Chaitar Vasava

- 24 hours rainfall data from across Gujarat; Bhiloda tops, Surat City had over 4.56 inch rain

- Chaturmas 2025 starts today across Gujarat; will end on 2nd November

- Gauri Vrat Goro begins across Gujarat ; Jaya Parvati Vrat from July 8

- Stray bull attacks man in Bhachau, Kutch; CCTV footage surfaces

- In pictures: Upcoming Five-Star Hyatt Hotel at GIFT City, Gujarat