ADIA to invest Rs. 5,683.50 crore in Jio Platforms

June 07, 2020

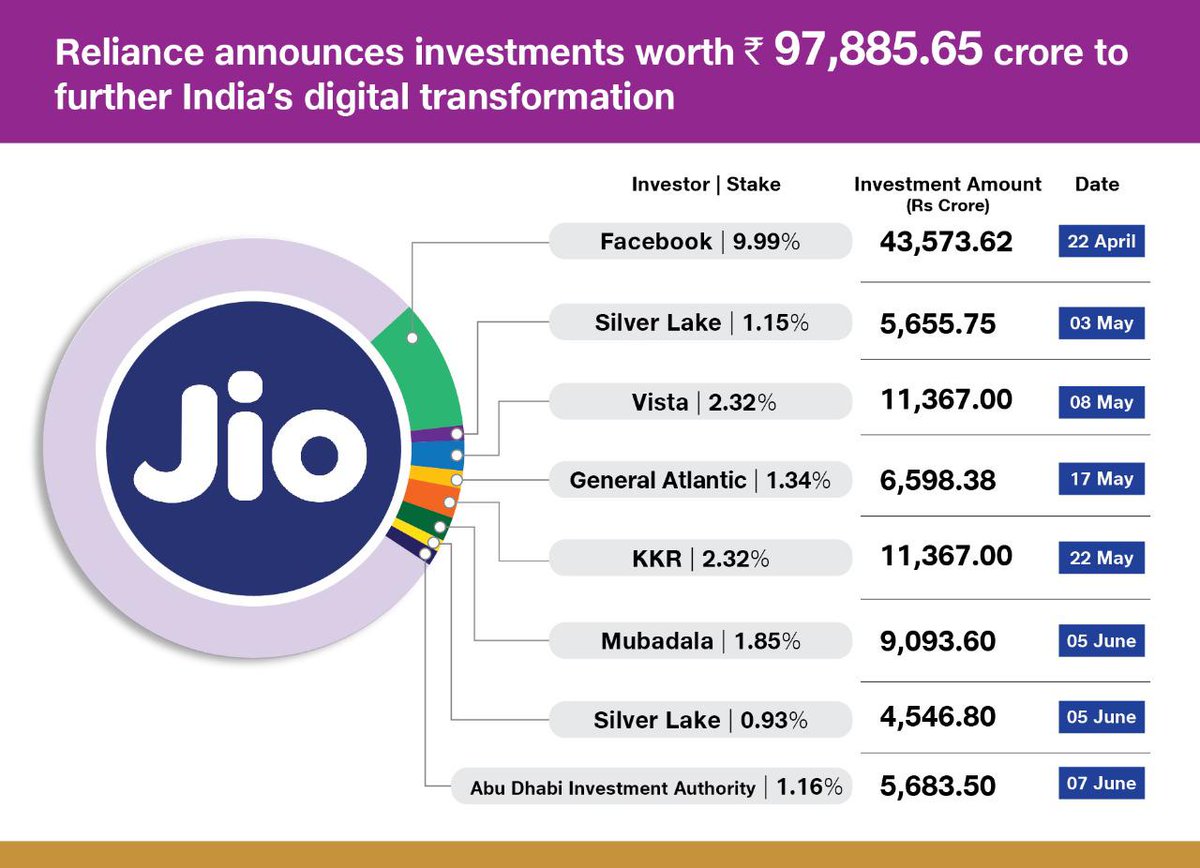

Mumbai: Reliance Industries Limited (“Reliance Industries”) and Jio Platforms Limited (“Jio Platforms”), India’s leading digital services platform, today announced an investment of Rs. 5,683.50 crore by a wholly owned subsidiary of the Abu Dhabi Investment Authority (“ADIA”). This investment values Jio Platforms at an equity value of Rs. 4.91 lakh crore and an enterprise value of ₹ 5.16 lakh crore. ADIA’s investment will translate into a 1.16% equity stake in Jio Platforms on a fully diluted basis. With this investment, Jio Platforms has raised Rs. 97,885.65 crore from leading global investors including Facebook, Silver Lake, Vista Equity Partners, General Atlantic, KKR, Mubadala and ADIA in less than seven weeks.

Established in 1976, ADIA is a globally-diversified investment institution that prudently invests funds on behalf of the Government of Abu Dhabi through a strategy focused on long-term value creation. ADIA manages a global investment portfolio that is diversified across more than two dozen asset classes and sub-categories.

Mukesh Ambani, Chairman and Managing Director of Reliance Industries, said, “I am delighted that ADIA, with its track record of more than four decades of successful long-term value investing across the world, is partnering with Jio Platforms in its mission to take India to digital leadership and generate inclusive growth opportunities. This investment is a strong endorsement of our strategy and India’s potential.”

Hamad Shahwan Aldhaheri, Executive Director of the Private Equities Department at ADIA, said: “Jio Platforms is at the forefront of India’s digital revolution, poised to benefit from major socio-economic developments and the transformative effects of technology on the way people live and work. The rapid growth of the business, which has established itself as a market leader in just four years, has been built on a strong track record of strategic execution. Our investment in Jio is a further demonstration of ADIA’s ability to draw on deep regional and sector expertise to invest globally in market leading companies and alongside proven partners.”

The transaction is subject to regulatory and other customary approvals.

Morgan Stanley acted as financial advisor to Reliance Industries and AZB & Partners, and Davis Polk & Wardwell acted as legal counsel.

Jio Platforms, a wholly-owned subsidiary of Reliance Industries, is a next-generation technology platform focused on providing high-quality and affordable digital services across India, with more than 388 million subscribers. Jio Platforms has made significant investments across its digital ecosystem, powered by leading technologies spanning broadband connectivity, smart devices, cloud and edge computing, big data analytics, artificial intelligence, Internet of Things, augmented and mixed reality and blockchain. Jio’s vision is to enable a Digital India for 1.3 billion people and businesses across the country, including small merchants, micro-businesses and farmers so that all of them can enjoy the fruits of inclusive growth.

Related Stories

Intel Capital, investment arm of Intel Corporation to invest Rs.1,894.50 crore in Jio Platforms

Reliance raises over Rs. 1,68,818 crore in less than two months

The Public Investment Fund (PIF) to invest Rs. 11,367 crore in Jio Platforms

L Catterton to invest Rs. 1,894.50 crore in Jio Platforms

Silver Lake and Co-Investors to invest additional Rs. 4,546.80 crore in Jio Platforms

Mubadala to invest Rs. 9,093.60 crore in Jio Platforms

KKR to invest Rs. 11,367 crore in Jio Platforms

General Atlantic to invest Rs. 6,598.38 crore in Jio Platforms

Vista to invest Rs. 11,367 crore in Jio Platforms at equity value of Rs. 4.91 lakh crore

Silver Lake to invest Rs. 5,655.75 crore in Jio Platforms at an equity value of Rs. 4.90 lakh crore

Facebook to invest Rs. 43,574 crore in Jio for 9.99% stake; largest FDI for minority investment in India

Recent Stories

- Kharai camels swim across sea from Kutch to Dwarka

- Mumbai-Ahmedabad Bullet Train project: Bridge over Daman Ganga River complete

- In Pictures: Surat's indoor sports facility center under Parle Point bridge garners praise from Tweeples

- Longest coastline, yet not a single sea cruise in Gujarat; govt to now bring Cruise Shipping Policy

- Gate repairs in Shedhi canal to impact water supply in Ahmedabad

- Ahmedabad civic body drafts policy to regulate booming box cricket, pickleball facilities

- Kharif sowing crosses 50% in Gujarat on 43.05 lakh hectares of land: Govt