BSE resolved 192 investors’ complaints against companies in June 2021

July 02, 2021

Mumbai: During the month, BSE received 232 complaints against 172 companies. In the same period 192 complaints were resolved against 141 listed companies. These resolved complaints include complaints brought forward from the previous periods.

| Type of complaints | Complaints received | Complaints resolved | |||||

| Against

Active Companies |

Against Suspended Companies | Total | Against Active Companies | Against Suspended Companies | Total | ||

| I | 27 | 2 | 29 | 20 | 2 | 22 | |

| II | 49 | 2 | 51 | 37 | 10 | 47 | |

| III | 10 | 0 | 10 | 5 | 0 | 5 | |

| IV | 49 | 2 | 51 | 34 | 0 | 34 | |

| V | 3 | 0 | 3 | 1 | 0 | 1 | |

| VI | 81 | 7 | 88 | 73 | 10 | 83 | |

| Total | 219 | 13 | 232 | 170 | 22 | 192 | |

The complaints received by BSE from Investors have been categorized as under:

| Type I | Non-receipt of money (Refund, Interest, Redemption, Fractional Entitlement.) |

| Type II : | Non-receipt of Equity shares ( Demat & Physical : In Public/Rights issue,

Remat, Transfer, Transmission, Conversion / Endorsement / Consolidation/ Splitting / Duplicate Certificate) |

| Type III | Non-receipt of Debt Securities ( Demat & Physical : In Public/Rights issue,

Remat, Transfer, Transmission, Conversion / Endorsement / Consolidation/ Splitting / Duplicate Certificate) |

| Type IV | Non-receipt of Corporate benefits / entitlements ( Dividend, Bonus, Rights form,

Buyback letter of offer, Delisting letter of offer, Annual Report ) |

| Type V | Non-receipt of Interest for delay in : ( Refunds, Dividend, Interest on debt security, Redemption of debt security , Securities ) |

| Type VI | Others ( Including Non-Adherence to Corporate Governance Norms ) |

Below table shows highest number of complaints pending against suspended companies as on 1st July, 2021.

| Sr. No. | Company Name | Category | Number of complaints pending as on 01/07/2021 |

| 1 | Inceptum Enterprises Limited | Z | 23 |

| 2 | J.K. Pharmachem Ltd. | X | 16 |

| 3 | Teem Laboratories Ltd. | X | 12 |

| 4 | Gujarat Perstorp Electronics Ltd | P | 12 |

| 5 | Gujarat Narmada Flyash Co. Ltd. | XT | 12 |

| 6 | Gujarat Meditech Ltd | Z | 11 |

| 7 | Saptak Chem And Business Limited | Z | 11 |

| 8 | Negotium International Trade Limited | XT | 11 |

| 9 | Blazon Marbles Limited | X | 11 |

| 10 | Global Securities Limited | XT | 10 |

These aforesaid companies are presently suspended at the Exchange for surveillance reasons/ certain non-compliances with the listing regulations/procedural reasons or as per operation of law.

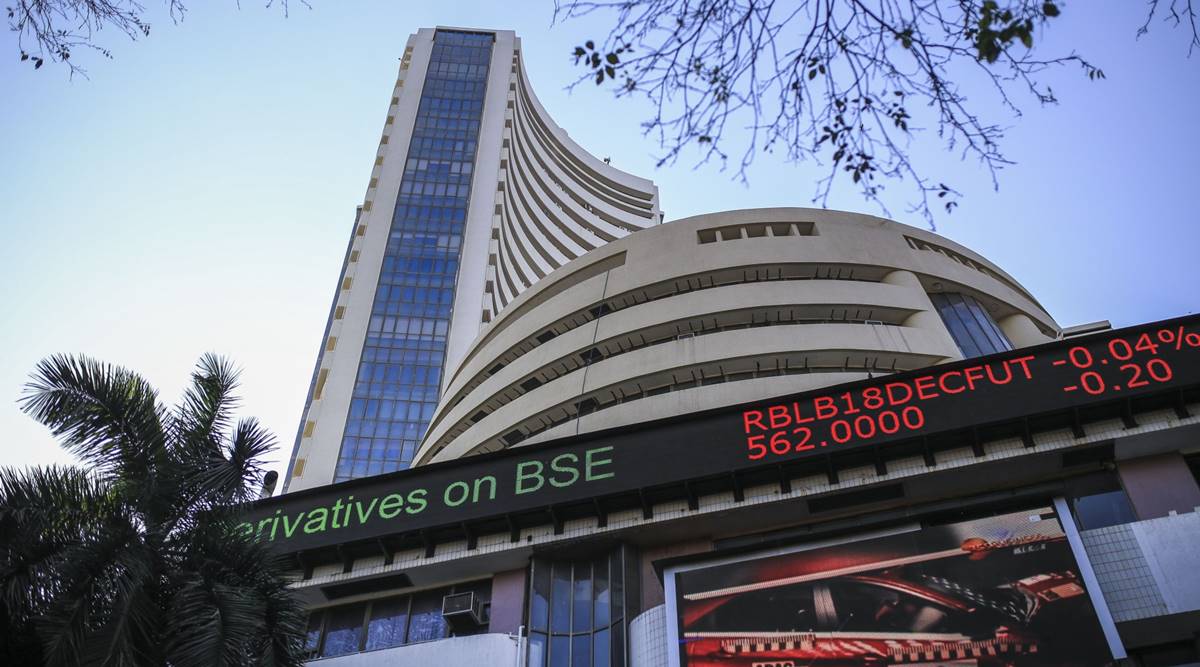

About BSE

BSE (formerly Bombay Stock Exchange) established in 1875, is Asia’s first & now the world’s fastest Stock Exchange with a speed of 6 microseconds. BSE is India’s leading exchange group and has played a prominent role in developing the Indian capital market. BSE is a corporatized and demutualized entity, with a broad shareholder base that includes the leading global exchange- Deutsche Bourse, as a strategic partner. BSE provides an efficient and transparent market for trading in equity, debt instruments, equity derivatives, currency derivatives, commodity derivatives, interest rate derivatives, mutual funds and stock lending and borrowing.

BSE also has a dedicated platform for trading in equities of small and medium enterprises (SMEs) that has been highly successful. BSE also has a dedicated MF distribution platform BSE StAR MF which is India Largest Mutual Funds Distribution Infrastructure. On October 1, 2018, BSE launched commodity derivatives trading in Gold, Silver, Copper, Oman Crude Oil Guar Gum, Guar Seeds & Turmeric.

BSE provides a host of other services to capital market participants including risk management, clearing, settlement, market data services and education. It has a global reach with customers around the world and a nation-wide presence. BSE’s systems and processes are designed to safeguard market integrity, drive the growth of the Indian capital market and stimulate innovation and competition across all market segments.

Indian Clearing Corporation Limited, a wholly owned subsidiary of BSE, acts as the central counterparty to all trades executed on the BSE trading platform and provides full novation, guaranteeing the settlement of all bonafide trades executed. BSE Institute Ltd, another fully owned subsidiary of BSE runs one of the most respected capital market educational institutes in the country. Central Depository Services Ltd. (CDSL), associate company of BSE, is one of the two Depositories in India.

BSE has set up an Investor Protection Fund (IPF) on July 10, 1986 to meet the claims of investors against defaulter Members, in accordance with the Guidelines issued by the Ministry of Finance, Government of India. BSE Investor Protection Fund is responsible for creating Capital markets related awareness among the investor community in India.

Recent Stories

- 7 killed as car crashes into parked truck on Jambusar-Amod highway in Bharuch

- Amit Shah inaugurates Sabar Dairy's new animal feed plant in Himatnagar, Gujarat

- Vyara MLA Mohan Kokani faces protest over religious conversion

- Indian Army concludes multi-agency disaster relief exercise 'Sanyukt Vimochan 2024' in Gujarat

- Stray cattle menace claims life of 25-year-old youth in Valsad

- Violence in J&K, North East, Naxal areas down by 70% in last 10 years: Amit Shah in Gujarat

- RBI imposes monetary penalty on 3 cooperative banks in Gujarat