Public debt ratio declines further, projected at 15.28% for 2025-26, well below the 27.10% limit: Kanubhai Desai

March 26, 2025

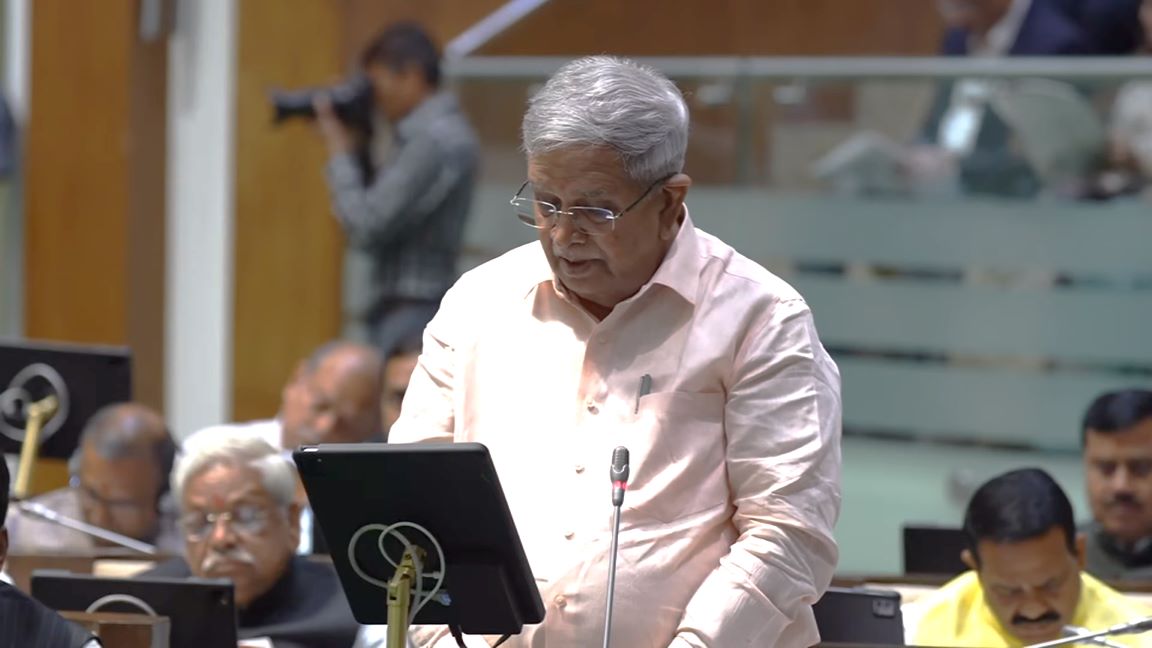

Gandhinagar: State Finance Minister Shri Kanubhai Desai, while presenting the budgetary demands of the Finance Department for 2025-26 in the Legislative Assembly, said that the department is working in a disciplined manner to ensure financial management as per the prescribed parameters of the Finance Act, 2005. He confidently stated that by adhering to these parameters, the state has successfully reduced the revenue deficit and ensured sound fiscal management and stability.

The Finance Minister highlighted that Gujarat, which holds a significant share in the country’s GDP, is one of the fastest-growing state economies. The state’s development journey, initiated two decades ago under the leadership of then-Chief Minister and current Prime Minister Shri Narendra Modi, continues to progress. At present, Chief Minister Shri Bhupendra Patel envisions making Gujarat a developed state while ensuring a prosperous life and income for its citizens (“Living Well & Earning Well”). The state government remains committed to this goal.

Discussing the state’s public debt, the Minister stated that the public debt-to-GSDP ratio is gradually decreasing, with an estimated 15.28 percent in 2025-26—significantly lower than the prescribed limit of 27.10 percent.

Shri Desai mentioned that the central government provides interest-free loans to states for capital investment projects, with Gujarat receiving ₹5,027 crore under this scheme in the current financial year. As a result, the average cost of interest payments on public debt has decreased.

Providing an overview of Gujarat’s economic growth over the past decade, the Minister noted that the average interest expense on public debt was 8.87 percent in 2014-15, which has decreased to an estimated 7.36 percent in the revised estimates for 2024-25. This decline reflects the state’s strong economic management.

On financial discipline and efficiency, Shri Desai stated that Gujarat’s fiscal deficit as a percentage of GSDP stands at 1.89 percent—lower than the prescribed 3 percent limit in the revised estimates for 2024-25. For 2025-26, it is estimated to be 1.96 percent. He also highlighted that Gujarat has excelled in financial management, as recognized in the February 2025 report of the National Council of Applied Economic Research.

Discussing state government assistance, Shri Desai revealed that by February 2025, direct benefit transfers (DBT) had been provided under 417 beneficiary-oriented schemes, with nine new schemes added to the DBT portal. Additionally, around 1.92 crore accounts have been opened under the Pradhan Mantri Jan Dhan Yojana, and 1.44 crore RuPay cards have been issued. Under the Pradhan Mantri Jeevan Jyoti Bima Yojana, 54,000 claims have been settled.

To enhance transparency in beneficiary-oriented schemes, biometric Aadhaar authentication has been implemented. By February 15, 2025, e-KYC verification had been completed for 3.63 crore ration cardholders (NFSA & Non-NFSA) under the Food and Civil Supplies Department.

Outlining budget provisions for 2025-26 inspired by Prime Minister Narendra Modi’s vision for “GYAN” (Garib, Yuva, Annadata, and Nari Shakti), the Finance Minister noted significant increases in allocations across various sectors compared to the previous year:

-

Sports, Youth, and Cultural Activities: 42.50% increase

-

Urban Development: 40% increase

-

Rural Development: 30.50% increase

-

Health and Family Welfare: 16.35% increase

-

Tourism: 30.98% increase

-

Home Affairs: 21.98% increase

-

Forest and Environment: 21.41% increase

The Finance Minister further announced the Gujarat Government’s roadmap for Developed Gujarat @2047, aligning with the national vision of Developed India @2047. To support this, the state has proposed a Developed Gujarat Fund of ₹50,000 crore for the next five years, with ₹5,000 crore allocated for the current year. This fund will support critical projects such as high-speed corridors, road infrastructure, water supply, industrial development, tourism, logistics parks, and power infrastructure.

Regarding tax administration, the Minister emphasized that the Finance Department is efficiently implementing GST, VAT, Electricity Duty, and Professional Tax. In 2024-25, tax revenues amounted to approximately ₹1.01 lakh crore by February 2025, with administrative expenses of only ₹320 crore—demonstrating the department’s efficiency, as the government spends just 3 paise to generate ₹100 in revenue.

Shri Desai reaffirmed Gujarat’s commitment to ease of doing business by providing faceless and transparent tax services. Most processes, including new registrations, amendments, refund applications, and return filings, have been made fully online. The use of modern technology, such as GSTN, NIC for e-way bills, GST analytics, and the State Tax Execution Monitoring Module, has enhanced scrutiny, audits, and investigations.

Gujarat ranks first in the country in e-way bill verification, thanks to the effective operations of mobile squads at key entry and exit points. The state’s GST base has expanded by 145% since its introduction in June 2017, with total taxpayers now at 12,46,581. To curb fraudulent registrations and simplify GST registration, 12 modern GST service centers have been set up within 75 days, using biometric verification.

The Minister reported that Gujarat’s GST revenue has increased by 15% this year, reaching ₹67,079 crore by February 2025. Gujarat leads in GST return filing, with 99.6% compliance among registered taxpayers for FY 2023-24. The state also tops nine key performance parameters in the GST Council Secretariat’s recent ranking.

Highlighting major GST concessions, Shri Desai stated that the GST rate on gene therapy has been reduced from 12% to 0%, making it tax-free for cancer patients, while the GST on cancer medicines has been cut from 12% to 5%.

Under the Integrated Financial Management System (IFMS), Gujarat taxpayers can now pay taxes online via internet banking. IFMS also ensures direct deposit of salaries, pensions, and benefits, while Digital Gujarat Portal integration allows 53 lakh students to receive Aadhaar-based scholarship and uniform assistance payments.

Discussing insurance, the Minister announced that under the Janata Group Accident Insurance Scheme, compensation for accidental death has been doubled from ₹2 lakh to ₹4 lakh, benefiting over 4.45 crore individuals, including widows, farmers, cattle breeders, unorganized workers, students, persons with disabilities, and sanitation workers.

Thus, the budgetary demands of the Finance Department were passed in the Legislative Assembly. DeshGujarat

Recent Stories

- Blast rocks Hong Kong-flagged vessel off Gujarat coast; 21 crew evacuated

- AERB grants 5-year operational license to Kakrapar's 700 MW indigenous reactors

- 24 hours rainfall data from across Gujarat; South Gujarat, Kutch top the chart

- Schools, colleges declared shut in Navsari following heavy rains, rising levels in rivers

- Shah in Anand hails Salt Cooperative Initiative of Kutch, predicts Rs. 1 lakh crore Turnover of Amul next year

- Section 144 imposed after arrest of AAP MLA Chaitar Vasava

- 24 hours rainfall data from across Gujarat; Bhiloda tops, Surat City had over 4.56 inch rain