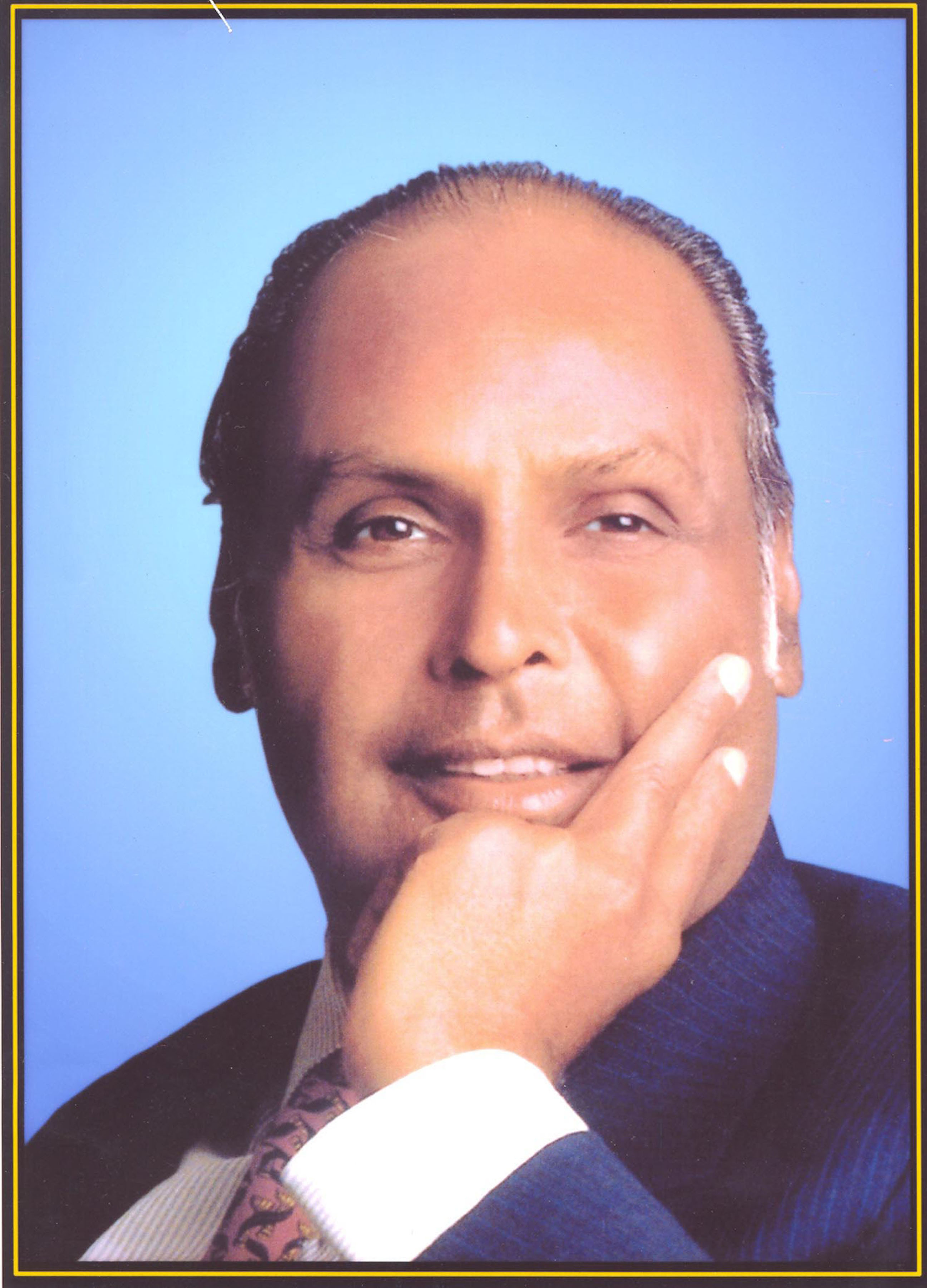

Dhirubhai Ambani: Father of the Indian Stock Markets

December 28, 2019

By Shri Parimal Nathwani

Recently, Reliance Industries Ltd (RIL) became the first Indian company to hit the market capitalisation mark of Rs 10 lakh crore, a new landmark for the country’s stock markets. On his 87th birth anniversary today, I am reminded of Shri Dhirubhai Ambani’s role as the ‘Father of the Indian Stock Markets’, and his passion for creating wealth for the middle-class retail investors. Investors of RIL have benefitted from the visionary Shri Dhirubhai Ambani and thereafter by his son, Shri Mukesh D. Ambani, who has carried forward the legacy of his father.

Listed in 1977, an investment of Rs 10,000 in Reliance at the time of IPO, would be worth about Rs 2.1 crore today as per an analysis done by CNBC TV18 in November end, 2019 – a humongous 209,900 percentage increase in investor wealth.

Dhirubhai was one of the world’s greatest business leader. With his unparalleled vision, enthusiasm, hard work and innovations, RIL became the first Indian private sector company to find its place in Fortune’s Global 500 list of ‘World’s Largest Corporations’. Today, under the leadership of Mukeshbhai, Reliance has overtaken IOC to become the largest company on the Fortune India 500 list.

Dhirubhai enjoyed creating wealth for the masses and for his country. He would say, “What is good for India is good for Reliance”. He was instrumental in shaping the ‘equity cult’ in India. In the 1960s and 1970s, the equity market in India was the preserve of an exclusive class of rich businessmen and brokers. Dhirubhai pulled down the walls of the rich man’s fortress, involved millions of middle-class Indians and showed them a new avenue for investment and earning. Thus, he created a new avenue for the middle-class people to park their money and earn better returns.

Since banks and financial institutions refused to lend the kind of funds that Dhirubhai wanted for his large new project, he decided to directly go to the people and raise funds from the masses. In 1977, he took Reliance public by floating an Initial Public Offer (IPO) and it was a huge success. More than 58,000 retail investors across the country reposed their faith in Dhirubhai and subscribed to the IPO. Thereafter, there was no looking back and retail investors have gained handsomely since then.

Dhirubhai tapped the bottom of the pyramid for funds, at a time when most business houses were relying on funding from state-owned financial institutions and banks. His faith in the retail investors also gave a big leg-up to the Bombay Stock Exchange (BSE) – lured by Reliance’s ability to deliver high dividends and appreciation in stock prices, thousands of retail investors flocked to the share market.

Many small investors worshipped Dhirubhai as a God. There are hundreds of examples where common people fulfilled social obligations like marriage of their children or paying their fees for education after getting high returns on investments made in Reliance shares. Looking at his success, other corporates in India started approaching the Indian masses to raise funds and thus the retail equity cult initiated by Dhirubhai began to spread.

Thereafter, Dhirubhai came up with many more innovative ways of raising funds for the first time in India. He showed Indian corporates how to raise funds at cheaper rates using Global Depository Receipts in 1992. Moreover, his was the first company from Asia to issue 50 and 100 years’ bonds in the US debt market in 1997.

Today, thanks to the equity cult initiated by Dhirubhai 42 years back, the Indian stock market ranks amongst the top 10 in the world in terms of market capitalisation – contribution of RIL is a major factor in this achievement.

(Mr. Parimal Nathwani is Senior Group President at Reliance Industries Limited and also a Member of Parliament, Rajya Sabha)

Related Stories

Dhirubhai Ambani’s Atmanirbharta

Dhirubhai Ambani: The visionary who valued water the most

Dhirubhai Ambani : Sublime Indianness

Dhirubhai Ambani: As Relevant Today As He Was In Past

Vibrant Dhirubhai Ambani

Dhirubhai Ambani: A University Personified

Revisiting Dhirubhai Ambani

Dhirubhai Ambani and Digital Revolution

Dhirubhai Ambani: Did He Get Adequate Recognition?

Dhirubhai Ambani: the Legendary Industrialist

Dhirubhai Ambani lived a parallel life of silent philanthropist

Recent Stories

- Ahmedabad Metro staff returns bag with ₹4.59 lakh cash to passenger

- Part of Ahmedabad Railway Station road shut for 3 months; traffic diversion announced

- Mascot Industrial Park inaugurated on Kadi Vithlapur Highway

- 5 illegal Bangladeshis nabbed at Ahmedabad Railway Station

- Shaktisinh Gohil re-elected to Public Accounts Committee (PAC) of Parliament

- AMC frees 1.5 lakh sq. m. of land, removes 4,000 illegal units at Chandola Lake

- Ticket prices announced for rides at Balvatika at Kankaria Lake Front